39+ deducting mortgage interest from taxes

This itemized deduction allows homeowners to subtract mortgage interest from their. Ad Over 90 million taxes filed with TaxAct.

:max_bytes(150000):strip_icc()/InterestDeductions-0c6d98dac2c64b9a93c07d8078ae5fdd.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

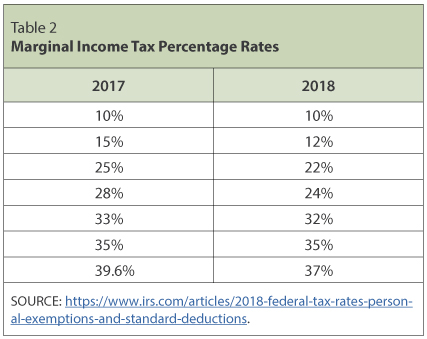

. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web The mortgage interest deduction is a tax incentive for homeowners.

Web Deducting mortgage interest - bought house 2022 sold old house 2023. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage.

Web Most homeowners can deduct all of their mortgage interest. Web The 2017 change to the current federal tax law limits the mortgage interest deduction a major tax break for homeowners. File your taxes stress-free online with TaxAct.

I have tried searching and found a few things but wanted to confirmclarify. Web The IRS places several limits on the amount of interest that you can deduct each year. Taxes Can Be Complex.

Filing your taxes just became easier. Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as.

Web As long as youve paid at least 600 worth of mortgage interest youll receive a notice from your mortgage holder or lender its usually Form 1098 a few. If so you must. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web Up to 96 cash back You might qualify for real estate tax deductions if you pay mortgage interest in advance for a period that goes beyond the end of the tax year. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of.

This has been a severe blow to not-so. We purchased a new. Taxes Can Be Complex.

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. However higher limitations 1 million 500000 if married. For tax years before 2018 the interest paid on up to 1 million of acquisition.

The amount you can deduct is limited but it can be. Homeowners who bought houses before. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web Is mortgage interest tax deductible. Interest on the first. Web The mortgage interest tax deduction allows you to deduct the interest you pay on your mortgage from your income taxes.

Web 2 days agoThis deduction is limited to interest paid on a mortgage used to purchase the property or a mortgage arising from refinancing that mortgage. Start basic federal filing for free. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

How Are Dividends Taxed 2023 Dividend Tax Rates The Motley Fool

2022 Taxes 8 Things To Know Now Charles Schwab

Which States Benefit Most From The Home Mortgage Interest Deduction

:max_bytes(150000):strip_icc()/property-tax-deduction-3192847_final-ca30dd2f9dcc4ce5b97d8a9e5615b3c7.png)

The Rules For Claiming A Property Tax Deduction

Why Do People Want To Tax The Rich Quora

:max_bytes(150000):strip_icc()/TermDefinitions_DeferredTax_V2-d5ae6ed922204f7eaa8bfb6b7b4b7f44.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction Or Standard Deduction Houselogic

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Individual Income Tax The Basics And New Changes St Louis Fed

Pdf Social Diagnosis 2011 Objective And Subjective Quality Of Life In Poland Full Report Irena Elzbieta Kotowska Academia Edu

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction A Guide Rocket Mortgage

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

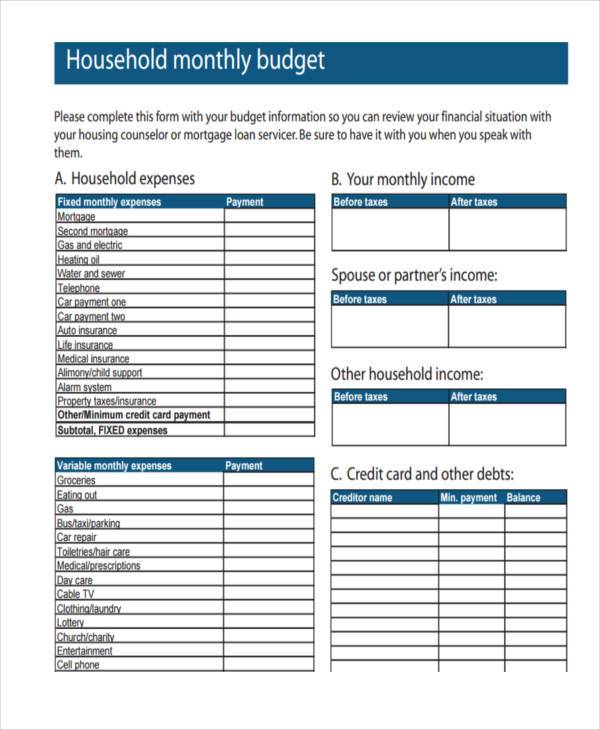

Free 39 Sample Budget Forms In Pdf Excel Ms Word

Important Info To Know On Foreign Mortgage Interest Deduction

What Is Debts In Finance Quora